Condo Insurance in and around Indianapolis

Welcome, condo unitowners of Indianapolis

Cover your home, wisely

- Indianapolis

- Greenwood

- New Palestine

- Beech Grove

- Lawrence

- Franklin

- Plainfield

- Carmel

- Fishers

- McCordsville

- Southport

- Fairland

- Shelbyville

- Irvington

- Avon

- Speedway

- Broad Ripple

Home Is Where Your Heart Is

When looking for the right condo, it's understandable to be focused on details like cosmetic fixes and needed repairs, but it's also important to make sure that your condo is properly insured. That's where State Farm's Condo Unitowners Insurance comes in.

Welcome, condo unitowners of Indianapolis

Cover your home, wisely

Protect Your Condo With Insurance From State Farm

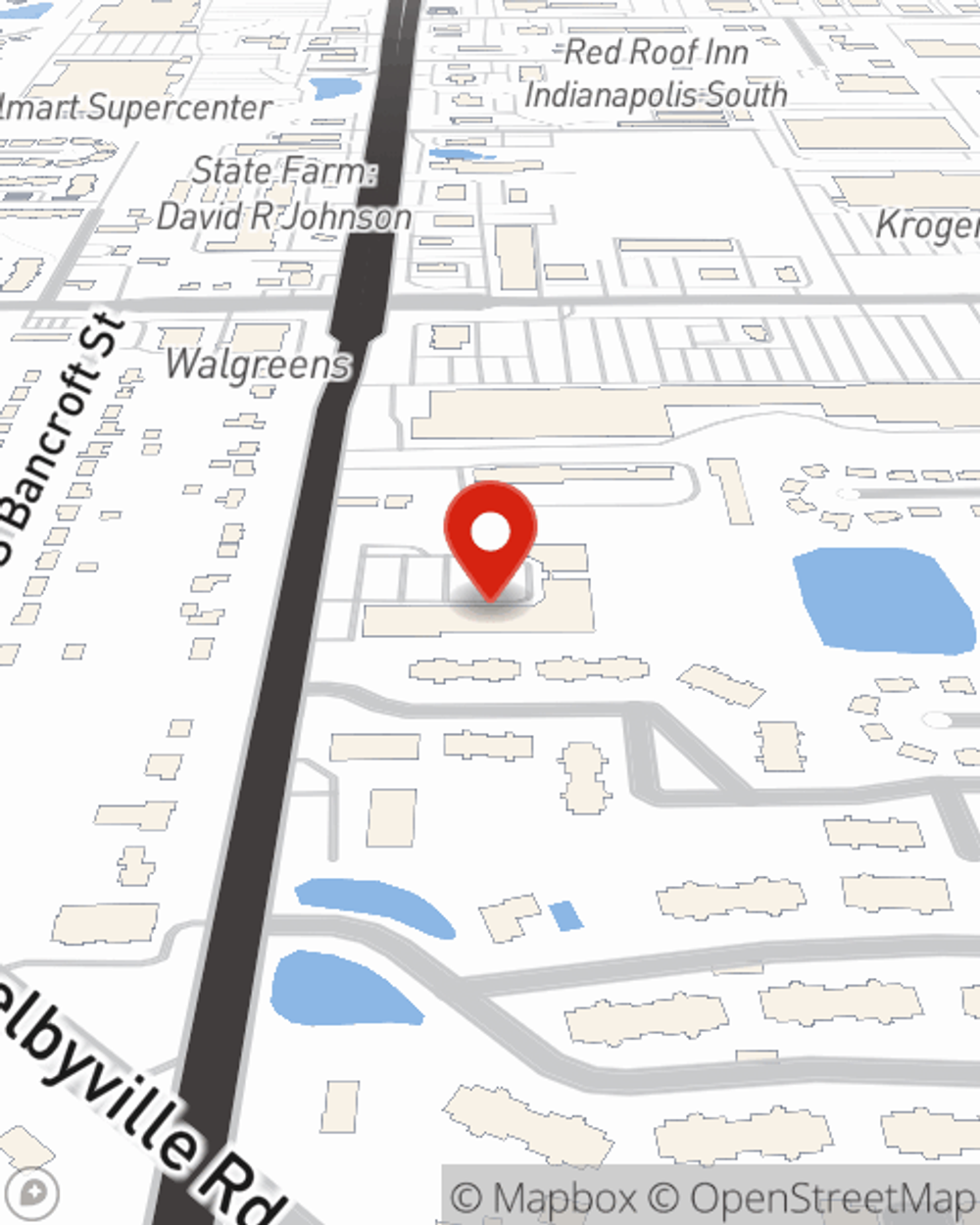

Things do happen. Whether damage from hail, smoke, or other causes, State Farm has dependable options to help you protect your condominium and personal property inside against unpredictable circumstances. Agent Bart Hile would love to help you build a policy that is personalized to your needs.

Getting started on an insurance policy for your unit is just a quote away. Get in touch with State Farm agent Bart Hile's office to learn more about your options.

Have More Questions About Condo Unitowners Insurance?

Call Bart at (317) 784-5044 or visit our FAQ page.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.